Our experts here at Loan Simple would like to help you start off 2016 on the right financial foot. This check list will help you make sure your money is in order for the New Year.

1. Review your monthly expenses

1. The last 3 months to be exact!

2. Where IS your money going?

3. Can you "cut" back?

4. What's necessary?

5. TAXES: Are you a CPA? Because if not you could be missing out hundreds of dollars monthly!

1. What tax bracket are you in?

2. What can I deduct?

3. Can I claim a temporary exemption?

4. Get with a professional and find out where you can save without penalty.

6. Set a NEW budget for the year and review it quarterly to ensure you’re on track!

2. Build your nest

1. Use the funds saved from your budget to build a nest you can use in a worst case scenario.

2. An emergency fund should have a minimum of 3 months income to cover basic necessities. To be more comfortable try to store up 6 months worth of income.

3. Invest wisely

1. Once you have a comfortable nest you'll want to invest those dollars into the BIG picture. There are a few areas you'll want to look at:

1. Buy a home! Real Estate is a long term investment that holds its value. An initial investment will keep a roof over your head and rental properties/ parcels are a great source of passive income. The equity you build can be a reservoir for our next point.

2. Plan for your retirement!

1. Diversify your portfolio! In other words, don't put all your eggs in one basket. There are more ways to contribute to your retirement than a 401k.

3. Insurance: a few dollars a month could save you thousands when it comes down to it.

1. The basics are

1. Life Insurance

2. Home Insurance

3. Car Insurance

4. Protect your assets

1. Life changes with the seasons and these markets change with us. While we can't be industry experts in everything we build a team of professionals to guide us along the way. Go to the information source and get educated about your personal situation. Get your policies, mortgage, and investment portfolio reviewed REGULARLY!

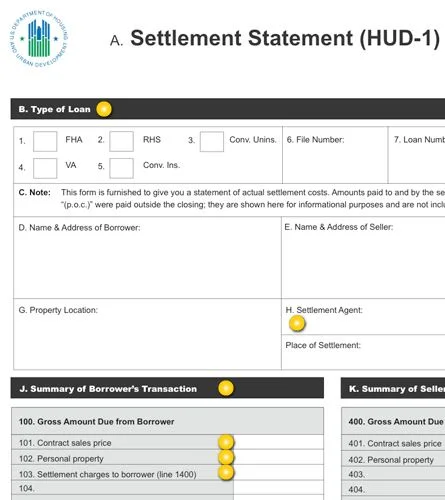

1. Mortgages: Get an Annual Mortgage Review by a local Loan Originator.

1. We also recommend getting the home inspected every 5 years to maintain your investment.

2. Ask a realtor to evaluate your property value based on the current market Annually.

2. Finances & Investments: Meet with a Financial Planner Quarterly to Semi-Annually.

3. Insurance: Agencies like State Farm and Geico have mass appeal but a broker is your best bet. You should review your policies at least Annually

Knowledge is power and if you've got questions our team of professionals can answer them for you! Give us a call and we'll help you review your financial checklist.