Finding your Facebook and Google Pixel & Snippet

Facebook Pixel

GOOGLE SNIPPET

Salesforce Training

Adding a lead in Salesforce

Creating a Needs List for the Lead

Converting The Contact

Pre-approval Process in Contact

Pre-approval Email Example

Sending The Pre-approval Letter

Cust & Paste this link: https://docs.google.com/forms/d/e/1FAIpQLSdWGp9t-LQn3mAlPW8MtMaFdf-y1QF15NXR0IFb0lBUmElbyw/viewform..

Then save to your favorits on your phone and on your desktop. Now watch the Video Below

Building the Opportunity

USDA Eligible Homes

Here is a guide to show you how to find homes that are with in the USDA eligible areas. This video will show you how to make sure your property is eligible for USDA financing.

Schedule a Time To Meet

Home Possible Mortgage (Freddie Mac)

Home Possible Advantage:

97% LTV

- LTV: Maximum LTV of 97 percent; TLTV 105 percent.

- Property Options: 1-unit properties, condos, and planned unit developments; manufactured homes are not eligible.

- Flexible Sources of Down Payments: Down Payment can come from a variety of sources, including family, employee-assistance programs, and secondary financing.

- Cancellable Mortgage Insurance (video): Mortgage insurance (MI) can be canceled after loan balance drops below 80 percent of the home's appraised value.

- Stable Mortgages: Fixed-rate mortgages with a term of up to 30 years.

- Refinance Flexibility (video): Purchase and no cash-out refinancing options available.

- Income Flexibility (video): Borrowers with incomes above AMI may be eligible in high-cost areas. No income limits in underserved areas. Use the Home Possible Income & Property Eligibility Tool to see income limits for specific properties.

- Primary Residence Only: All borrowers must occupy the property as their primary residence.

Home Possible:

95% LTV

- LTV: Maximum LTV and TLTV of 95 percent.

- Property Options (video): 1-4 units, condos and planned-unit developments; manufactured homes are eligible with certain restrictions.

- Flexible Sources of Down Payments:Down Payment can come from a variety of sources, including family, employer-assistance programs and secondary financing.

- Cancellable Mortgage Insurance (video): Mortgage insurance (MI) can be cancelled after loan balance drops below 80 percent of the home's appraised value.

- Mortgage Flexibility: 15- to 30-year fixed-rate mortgages, 5/1, 5/5, 7/1 and 10/1 ARMs.

- Refinance Options (video): No cash-out refinancing option is available for borrowers who occupy the property.

- Income Flexibility (video): Borrowers with incomes above AMI may be eligible in high-cost areas. No income limits in underserved areas. Use the Home Possible Income & Property Eligibility Tool to see income limits for specific properties.

- No Credit Score Necessary (video):Borrowers without credit scores are eligible for mortgages with down payments as low as five percent. Learn more. [PDF]

Avoid Monthly Mortgage Insurance

3 Ways to Pay Mortgage Insurance on a Conventional Loan

- Monthly

- One Time Fee

- Can be financed or

- Paid out of Pocket or

- Lender can pay with a credit

- Or paid by the seller

- Split between a monthly fee and a 1-time fee

Do you have mortgage questions?

Or

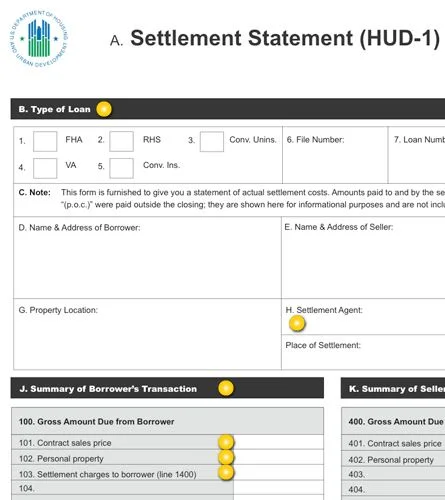

Out of Pocket Expenses

Out of Pocket Expenses when purchasing a home

Here are the out of pocket expenses a buyer should expect when purchasing a home. These expenses are paid prior to the loan closing. This means there is a chance the buyer could potentially be risking these expenses when making offers on homes.

- Earnest Money Deposit $500 - $1,000

- Appraisal $500 - $600

- Home Inspection $150 - $250

- Pest Inspection $95 - $110

- Well and Septic Test $300 - $400

Earnest Money Deposit

The EMD is a deposit that is given to the title company when the seller accepts the buyers offer. The deposit is a good faith deposit from the buyer that says that the buyer is serious about buying the house and is willing to forfeit their deposit if they were to change their mind after the contingency period of the escrow.

The buyer does have the right to ask for a 17 - 30 day (sometimes longer) contingency period. With the contingency period, the buyer has that time to inspect the property before deciding if they want to execute the right to purchase the home. If for any reason the buyer decides after inspecting the home that they no longer wish to purchase the house they buyer may choose to exit the contact and get his or her earnest money back.

Its important to have an experienced realtor that knows how to effectively negotiate for the buyer so that the buyer has little risk of losing their deposit.

Appraisal

The lender normally orders the appraisal as soon as the seller accepts the purchase offer. The appraiser will want to get paid prior to going out to the property. The appraisal will normally cost about $500. Sometimes the appraisal can be more because of the location of the the property or the complexity of the property. For example a multi unit will be more expensive than a single family residence.

Required by lender

Ordered by lender

Home Inspection

I always will recommend getting a home inspection completed prior to closing on your new home. This will be the first inspection to order. The reason its the first inspection is because if you find something that you do not like and decide not to purchase the home you have only spend $250. If you ordered the appraisal then the home inspection you would be out the appraisal and also the inspection money if you decided not to purchase the home.

Not required by lender

Ordered by borrower or realtor

Pest Inspection

The pest inspection is only $95 - $110. Most of the time this inspection is completed by the seller. If the seller does not have a pest inspection on file we recommend the buyer always get a pest inspection. There are some loans that require the seller to pay for the pest inspection and also any pest work to be completed.

The VA loan is the only loan that requires a clear Section 1 pest report. The VA requires the seller to pay for the pest inspection and requires the seller to pay for the pest inspection. However the buyer can increase the purchase price for the seller to then pay for any pest work to be completed.

Well Inspection

The well inspection is going to be about $300 - $400. This can be negotiated for the seller to pay. The well inspection is required by the lender. The lender will want to insure that there is sufficient source of water to the home and that the water is not contaminated.

'Required by the lender

Ordered by the realtor or the buyer

Septic Inspection

The septic inspection is not going to be a requirement from the lender unless the appraiser mentions something in his report. The septic inspection will run about $300-$400. This inspection is also negotiable for the seller to pay as well.

Not required by the lender (Unless in the Appraisal Report)

Ordered by the realtor or the buyer

Pre-approval Process in 4 Easy Steps

Pre-approval Process

- Application and Information Gathering

- Document Review and Completing AUS

- Submitting your loan to Underwriting (Credit Approval)

- File comes back from underwriting

Veterans with Service Connected Disability

The VA loan for Redding Ca Veterans and an amazing loan. Especially if the veteran has a service connected disability of 10% or more.

If a Redding Ca Veteran is applying for a low VA loan Interest rate he will be eligible for the VA funding fee to be waived if he has 10% or more of service connected disability. The Veteran will receive even more benefits with his VA loan if he has 100% VA connected disability.

How to waive your Property Taxes and lower your VA Loan Payment

If the Redding Veteran has 100% disability through the VA the Veteran will be allow to have his property tax waived up to a specific amount set by the State of California. There are limitations and income limits to this property tax exception for the Veteran.

What is an AUS or Automated Underwriting System?

Do NOT pay off your collections

For more questions regarding your collections please give our office a call. We would be happy to go over your credit and options with you.

Increasing your credit with Secured Credit Cards

Here is a link to use when looking to open up a secured credit card.

2016 Financial Checklist

Our experts here at Loan Simple would like to help you start off 2016 on the right financial foot. This check list will help you make sure your money is in order for the New Year.

1. Review your monthly expenses

1. The last 3 months to be exact!

2. Where IS your money going?

3. Can you "cut" back?

4. What's necessary?

5. TAXES: Are you a CPA? Because if not you could be missing out hundreds of dollars monthly!

1. What tax bracket are you in?

2. What can I deduct?

3. Can I claim a temporary exemption?

4. Get with a professional and find out where you can save without penalty.

6. Set a NEW budget for the year and review it quarterly to ensure you’re on track!

2. Build your nest

1. Use the funds saved from your budget to build a nest you can use in a worst case scenario.

2. An emergency fund should have a minimum of 3 months income to cover basic necessities. To be more comfortable try to store up 6 months worth of income.

3. Invest wisely

1. Once you have a comfortable nest you'll want to invest those dollars into the BIG picture. There are a few areas you'll want to look at:

1. Buy a home! Real Estate is a long term investment that holds its value. An initial investment will keep a roof over your head and rental properties/ parcels are a great source of passive income. The equity you build can be a reservoir for our next point.

2. Plan for your retirement!

1. Diversify your portfolio! In other words, don't put all your eggs in one basket. There are more ways to contribute to your retirement than a 401k.

3. Insurance: a few dollars a month could save you thousands when it comes down to it.

1. The basics are

1. Life Insurance

2. Home Insurance

3. Car Insurance

4. Protect your assets

1. Life changes with the seasons and these markets change with us. While we can't be industry experts in everything we build a team of professionals to guide us along the way. Go to the information source and get educated about your personal situation. Get your policies, mortgage, and investment portfolio reviewed REGULARLY!

1. Mortgages: Get an Annual Mortgage Review by a local Loan Originator.

1. We also recommend getting the home inspected every 5 years to maintain your investment.

2. Ask a realtor to evaluate your property value based on the current market Annually.

2. Finances & Investments: Meet with a Financial Planner Quarterly to Semi-Annually.

3. Insurance: Agencies like State Farm and Geico have mass appeal but a broker is your best bet. You should review your policies at least Annually

Knowledge is power and if you've got questions our team of professionals can answer them for you! Give us a call and we'll help you review your financial checklist.

Pete Metz 2015 Photoblog

I had an absolutely AMAZING year! What better way to reflect on 2015 than with a photoblog. Enjoy! :)

Winning at Winter Break

The kids are out of school for 2 weeks and you just spent a small fortune on the holidays. How will you survive? Don't worry Redding community our top 5 FREE family oriented activities will have you winning at winter break!

Make cookies or other holiday treats and deliver them to your neighbors or your local fire station or loved ones

Although you may not want to keep too many treats in the house, there may be others would love the kindness of home-baked goodies. Consider those who may not have family nearby or have to work over the holidays.

Have a family slumber party under the tree

Young children love ‘camping’ indoors, so grab pillows and blankets and spend the night sleeping underneath it.Holiday books from the library

Save money and have fun taking the family to the library to pick out a pile of holiday books that can be read over and over again before being returned to the library. Make a note of favorite books and buy them when they’re discounted after the holidays.Redding Library

1100 Parkview Ave

(530) 245-7250

Open until 8:00 PM

Anderson Branch Library

3200 W Center St

(530) 365-7685

Cottonwood Community Library

3427 Main St

(530) 347-4818

Have a fancy dress code for dinner one night

If you’ve already bought the clothes for other holiday events, you may as well have fun getting to where the fancy grab again. Let your kids choose the meal, light a couple of candles, turn down the lights and enjoy the giggles of a special night.Play in the snow!

Mt. Lassen and Mt. Shasta are covered with snow this year, make the most of it! Snowmen, snow angels, snowball fights and snow forts offer hours of fun for all ages.

Mount Shasta Ski Park is a ski resort located in northern California, just east of Interstate 5 along SR 89 between the city of Mount Shasta and the town of McCloud

4500 Ski Park Hwy, McCloud, CA 96057

9:00 AM – 4:00 PM

(530) 926-8610

For a full list of FREE winter break activities check out our friend Tony Robbins!